The Ultimate FBT Guide: Hosting a Tax-Smart Australian Christmas Celebration

As tinsel goes up, so does the risk of a Fringe Benefits Tax (FBT) bill. While Christmas parties and gifts are essential for team morale, Australian employers must navigate the complex rules of the Australian Taxation Office (ATO) to avoid a costly holiday hangover.

FBT is an employer's tax on non-cash benefits provided to employees (or their associates) and is currently levied at a significant 47% rate. Strategic planning is crucial to keep your celebrations memorable and tax-efficient.

What is Fringe Benefits Tax (FBT)?

FBT is a tax paid by the employer on the taxable value of certain benefits provided to employees or their family members, in addition to their salary. It is separate from income tax and is governed by its own financial year: 1 April to 31 March.

FBT Rate: 47%

FBT Year: 1 April to 31 March (e.g., December 2025 events fall into the FBT year ending 31 March 2026).

Key Deadline: FBT returns are typically due by 21 May (unless using a tax agent).

Your Best FBT Defence: The Minor Benefits Exemption

The Minor Benefits Exemption is the single most powerful tool for making Christmas events and gifts FBT-free.

A benefit is exempt from FBT if it meets all three conditions:

Value Test: The benefit must be less than $300 (including GST) per person.

Infrequency Test: It must be provided infrequently and irregularly.

Connection Test: It must not be a reward for performance (e.g., a Christmas gift is fine; a "sales target bonus" is not).

Tax Rules for the Entertainment (yes, especially the upcoming Christmas parties)

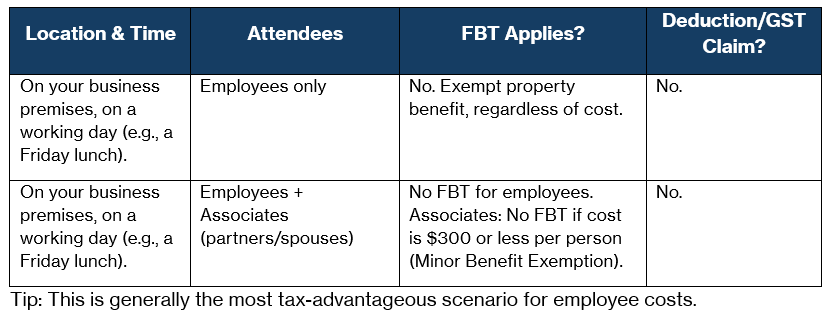

The tax treatment of your Christmas event depends heavily on where it is held and who attends.

1. On-Premises Events (The Safest Option)

2. Off-Premises Events

3. Non-Employees (Clients, Contractors)

FBT never applies to benefits provided to clients, contractors, or suppliers. However, the associated entertainment costs are not tax-deductible, and you cannot claim GST credits.

Tax Rules for Staff Gifts

Gifts are categorised as either 'Non-Entertainment' or 'Entertainment' and are assessed separately from the Christmas party cost against the $300 threshold.

1. Non-Entertainment Gifts (The Best Option)

These are tangible items that are not generally consumed or used for enjoyment, such as:

Hampers (food/wine)

Gift cards/vouchers for department stores, supermarkets, or general retail

Flowers or perfume

Books, tech gadgets (e.g., headphones)

2. Entertainment Gifts (Less Tax-Efficient)

These are considered 'recreation' or 'amusement', such as:

Vouchers for specific restaurants, spas, or theatres

Tickets to sporting events, concerts, or the cinema

Holiday or travel packages

3. Cash Bonuses and Cash Vouchers

These are not a fringe benefit. They are treated as salary and wages, meaning:

PAYG withholding applies.

Superannuation contributions are required.

They are taxable income for the employee.

Strategic Planning Checklist

Cap the Cost: Set a strict budget to ensure the total cost per person (employee or associate) for the party or any individual gift stays below $300 (GST inclusive) to activate the minor benefits exemption.

Choose Wisely: If hosting off-site, budget carefully. If hosting on-site during a workday, employee costs are exempt regardless of price.

Best Gift Strategy: Opt for non-entertainment gifts valued under $300. This gives you the ideal trifecta: FBT-free, tax-deductible, and GST-creditable.

Separate Costs: Ensure your party and gift costs are assessed separately against the $300 threshold. For example, a $250 party + a $200 hamper could be FBT-free.

Record Everything: Keep detailed records of invoices, total costs, and attendee lists (clearly identifying employees vs. associates vs. clients) for five years.

The tax rules for employee benefits are complex. Strategic, year-round planning is essential to minimise your tax liability. Don't wait until the FBT year ends on March 31st to discover unexpected costs.

Align your staff benefits budget with ATO compliance and ensure every dollar spent on your team is tax-efficient, whether it's for a Christmas party, an annual award, or a staff incentive.

Click below to schedule your FBT Strategy Session with one of Alexander Spencer’s trusted advisor.

Disclaimer: This blog post provides general information on Fringe Benefits Tax (FBT) in Australia and should not be considered professional tax advice. We strongly recommend that you seek personalised advice from your dedicated Alexander Spencer advisor or a qualified tax professional before making any decisions based on this content.